The Market Stream Innovation Management System (Market Stream IM) is Legacy Innovation Group's proprietary system for Innovation Management.

Market Stream IM provides the operational and governance procedures needed to drive a funnel and pipeline of new innovation ideas – a very important element of a broader Corporate Innovation program like our Responsive Innovation Engine. This includes all of the procedural mechanisms needed to capture, evaluate, and implement new ideas and business opportunities.

The name "Market Stream" derives from the fact that a good innovation management system produces constant streams of new business ideas that lead to new market opportunities, whether they be new offerings, entirely new business models, or the creation of entirely new markets. These in turn lead to innovative solutions for emerging market needs, and in so doing constantly renew the connectedness (and relevance) between businesses and markets.

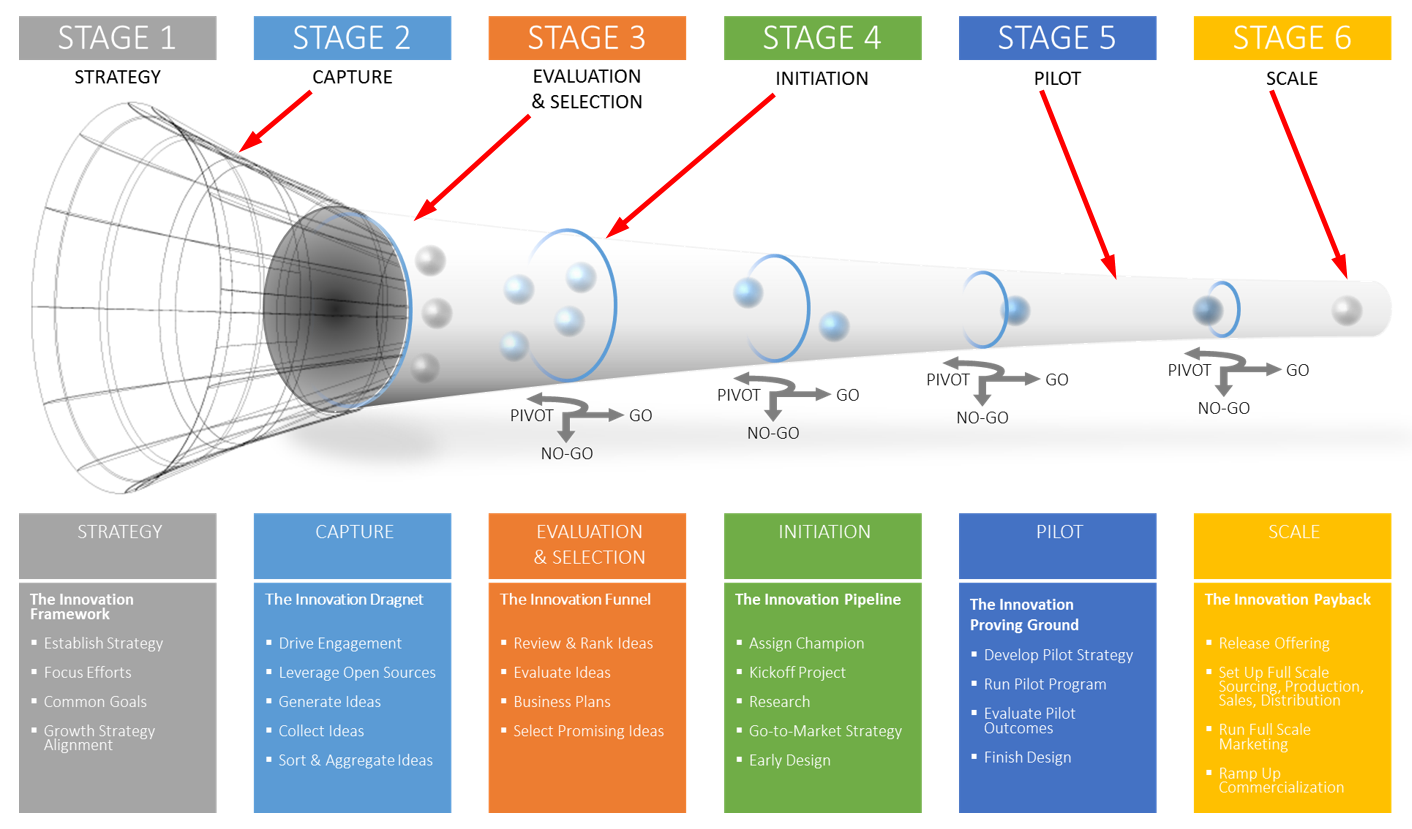

Market Stream IM involves a six–stage system focused on strategy, capture, evaluation, initiation, pilot, and scale. Within these six stages, certain activities will be strategic, while others will be tactical. All have the potential to involve political considerations within the organization (and there are ways of managing that effectively). The first stage is foundational – it lays the foundation necessary for the rest of the stages to be successful. The next three stages (2, 3, & 4) are procedural and can be thought of as the working engine of the system. The second stage addresses the capture of ideas, the third stage addresses the evaluation of ideas, and the fourth stage addresses the early incubation of actual innovation projects. The last two stages (5 & 6) are about commercializing new offerings, starting at the pilot level and then scaling up to full market potential. These six stages represent a cyclical process that should be in perpetual motion, thus maintaining a healthy and productive Innovation Pipeline.

Market Stream IM sits in between our Responsive Innovation Engine (Corporate Innovation) Architecture and our Emergent NPD Process, and works effectively in harmony with both of these, bridging the high–level strategic work of the former with the more tactical work of the latter. More specifically, Market Stream IM is the innovation management piece of Responsive IE, and therefore supports the broader corporate innovation program. On the other side, much of the work associated with its latter stages of implementation and commercialization draw upon Emergent NPD to establish such things as market and user insights, brand and product strategies, design strategies, commercialization strategies, and so forth. This makes for a highly effective integrated system that can be used to deliver sustained innovation and growth.

Because evolving an organization into an innovation–driven one takes time, and because learning to use IM tools and processes effectively takes effort and a clear sense of direction, Market Stream IM provides the playbook needed to achieve sustainable success.

The first and most foundational step in innovation management is the establishment of an underlying innovation strategy (or collection of strategies where multiple growth vehicles are being used, each with their own strategy). This strategy must be clear and specific and must be aligned with the broader overall business strategy.

The innovation strategy will address such questions as what size and shape and market speed the innovation portfolio must have. Are there to be a few disruptive innovations, or many incremental innovations? What resources are available to pursue more versus fewer innovations? What are the relative risks and rewards of different innovation strategies? How fast does the company need to move relative to shifting market dynamics and/or competitive threats? Are they looking to expand into entirely new markets? And so on.

The innovation strategy will establish specific goals and objectives. These will in turn guide specific investment priorities with respect to the overall innovation portfolio.

The innovation strategy also serves to bring into alignment a number of supporting activities, processes, and structures, including:

Within any given organization, a variety of growth vehicles may be in use to make up its overall innovation portfolio, and each of these may have its own particular funnel and pipeline (as well as its own investment budget). Consequently, each such vehicle / funnel / pipeline will have its own particular strategy that lives inside the broader corporate innovation strategy. The steps that follow from here will focus on a single such pipeline.

There is also an important Public Relations element to your broader corporate innovation strategy. Quite simply, it must be compelling. It must be compelling to the company's markets (its external constituency), the company's staff (its internal constituency), and the company's investors (its financing constituency). The markets provide the "pull" from the outside, the staff provides the "push" from the inside, and the investors provide the capital to run the engine that brings the first two together. Ultimately, this innovation strategy must capture the hearts and minds of all three of these if it is to be effective and sustainable over the long run.

Procedurally, the innovation management process begins with the capture and accumulation of ideas around potential innovations. This will include both the identification of new opportunities and the articulation of solutions to address these opportunities.

This stage is home to a whole host of diverse approaches for engaging participants in the innovation process. These can include ideation challenges, innovation jams, hackathons, innovation workshops, crowdsourced innovation tournaments, and so on (for a more comprehensive list, see Engagement within Responsive IE). Whatever approaches are used, they should fit the organization and its needs at the time so as to yield optimum engagement and best outcomes.

In terms of actually capturing and cataloging ideas, there are many means for doing this, including a number of automated software solutions. The general aim is to capture and accumulate as many potential ideas as possible, though as experience is gained with this process, organizations typically find ways to focus on the quality of ideas and not simply the quantity of ideas.

Generally speaking, idea capture can be an ongoing process for broad and open–ended needs. However, experience has proven that the best results are achieved when targeted "challenge" campaigns are used to focus participants' thinking around a specific need. This is where the highest quality ideas typically originate. Further to this same point, while idea capture is a necessary process, amassing ideas that may lead to innovations should not be mistaken for innovation itself. Ideas by themselves are not innovations. Only executed ideas are innovations. And only executed good ideas make for meaningful and relevant innovations.

Also, so that participants can be duly recognized and rewarded for their ideas (should they be implemented), idea capture should carefully track who the originators are (unless they explicitly opt to remain anonymous).

The idea capture space is often thought of as the Dragnet preceding the Innovation Funnel.

In this stage, with a steady stream of ideas being captured in an ideas database, a designated Evaluation Group will undertake the process of evaluating each idea for business and market merit and selecting those ideas that warrant further examination. This is an ongoing review and vetting process used to flag ideas that justify spending more time and effort to work on. Those ideas not selected are either permanently culled or placed in a "parking lot" for future revisitation. Depending on the objectives involved, it is not uncommon to have multiple Evaluation Groups, with different groups focusing on the different engagement mechanisms of a Corporate Innovation program (see Engagement in Responsive IE).

At this point, the process progresses through a series of refining steps involving review, ranking, and initial selection. Ideas that make it into initial selection will typically have a straw–man business plan developed for them, perhaps using a straightforward tool such as a Business Model Canvas, though more formal and succinct business plans can also be used. Either of these will aid in further vetting the concept.

Subsequently, the Evaluation Group must facilitate a formal selection process. Depending on the organization, they will either do this themselves, or more often than not, they will do this by having each business case pitched to a formal Selection Panel. The Selection Panel is typically made up of senior business executives from across the company. The Evaluation Group will either pitch the business cases themselves or they will have the idea originators pitch them. The latter typically brings more passion into the process. The Selection Panel is sometimes referred to as the "Angel Committee" and this process the "Angel Pitch". The Evaluation Group may or may not add their own recommendations, depending on whether or not these are sought from the Selection Panel. In the end, the Selection Panel will decide which, if any, of these ideas are to be passed on for introduction into the formal Pipeline.

It is important to note here that organizations benefit greatly from having a well–defined and transparent innovation governance process in place. The innovation governance process lays out specifically what financial and business criteria are to be used in evaluating and comparing competing ideas. Definition and transparency around this ensures that all ideas are treated fairly and equitably and are given equal consideration based on their own merits against a consistent and relevant set of criteria. By the same token, organizations must undertake every reasonable effort to use real data in their decision–making process, rather than relying on people's opinions. Being data–driven forces them to accept reality as it is, rather than as they might wish it to be. That being said, all parties should also recognize and accept the fact that the level of confidence around forecasted metrics like market size and expected revenue earnings will be low this far up in the Front End of Innovation. This means there will inherently be a certain level of subjectivity and judgment involved in the evaluation process... something that simply cannot be avoided at this stage in the broader innovation process.

Ideas that get selected for formal commercialization will at some point each need a champion within one of the company's business units. It will be this champion's job to help make the case for the idea within that business unit and help get it off the ground. For this reason, it is imperative that the formal Evaluation Group build and maintain a broad network of business unit champions across the entire business.

By using this systematic process of idea evaluation and selection, a company can begin to shape its innovation portfolio to have the size, shape, and market speed that is needed to align to its previously established innovation strategy(ies).

This idea evaluation space is referred to as the Innovation Funnel (or i–Funnel), and is the first half of the Innovation Portfolio, preceding the second half, the Innovation Pipeline.

The fourth stage of innovation management begins the process of taking new business ideas from concept to reality. It starts when ideas have been selected for implementation. At this stage, initial business justification will have been completed and signed–off on, and so the focus moves to fostering the successful initiation of the idea so that it has a fair chance of getting off the ground and making it on to Stage 5.

This stage is often referred to as "innovation's first mile". It involves an attention–demanding incubation process requiring a certain level of oversight, involvement, and championing by select leaders. It must be owned and seen through up to a certain milestone in the process, or until a pilot project has successfully demonstrated its commercial viability. There may continue be a lot of iterative insights and discovery loops here, as the underlying hypotheses continue to be tested and the concept further refined. Hand–offs can occur once the project has established a firm grounding. Throughout the project, there must be appropriate types and levels of resource support provided. It is the job of the leadership champion to ensure the project gets the level of attention and the types and levels of resources it needs.

This project initiation space is referred to as the Innovation Pipeline (or i–Pipe), and constitutes the second half of the Innovation Portfolio. As projects are worked on throughout the Pipeline, they will face a number of go/no-go decision points and hurdles they must navigate. Those projects that make it all the way through to the end and become fully commercialized can be thought of as the Innovation Flow (or i–Flow). Somewhere along the way within the Pipeline, many projects will end up merging into the organization's normal product development process.

Since the Innovation Pipeline will generally have its own subset of phases within the flow of the pipeline, the overall value of projects associated with each phase should be regularly monitored and compared against specific goals for that phase. This will help to ensure a certain guaranteed value for the final output of the pipeline (an ongoing value applied for each quarter).

Throughout Stage 4 the organization is afforded many opportunities to have creative feedback loops, where they learn how best to reinforce, redirect, and/or – where necessary – kill new ideas.

Very often, depending on the commercialization strategy selected, the offering will be developed and commercialized only on a limited scale... a pilot of the offering. This is the fifth stage of innovation management and continues the process of taking new business ideas from concept to reality. The purpose of the pilot is to provide an opportunity for commercial validation of the concept – final confirmation that its underlying hypothesis and chosen solution are in fact valid and can successfully scale up to the market's full potential.

Sometimes, for very select cases, there is surrogate market insight that in and of itself gives the organization very high confidence in the commercial validity of a concept. In those limited cases, the pilot may be foregone altogether. In all other cases, the pilot provides a valuable opportunity to prove–out the concept.

By running a pilot, the organization is able to best manage its risks. Given that full–scale production of an offering – depending upon the nature of the offering – may entail major capital investments and the establishment of large–scale supply chains and distribution channels, and/or broad–scale service infrastructures with their associated training and preparation, the pilot allows the organization to prove that these investments are in fact justified prior to making them. It is, in essence, a safer and more cost–effective approach to learning the market's response to the offering prior to going full–scale. If the offering fails, it at least fails faster and with the least amount of fall–out. If it succeeds, then the organization learns quickly why it is succeeding, and how it can best leverage that. In this regard, pilots provide valuable feedback from the market that helps the organization fine–tune the value proposition prior to scaling it. Finally, the pilot will also help to ensure the offering will merge as intended with the rest of its brand portfolio. Once the pilot has demonstrated that the concept is commercially viable, it is then passed onto Stage 6 where it is ramped up to full scale.

The actual "flavor" and scale of pilots will vary greatly depending on the size and age of the organization and the industry it is in. In the case of startup software companies, for example, the pilot may take on the flavor of a minimum viable product (MVP). However in the case of large, established brands, the pilot will generally be a more well–developed offering, as this avoids the risk of incurring brand damage. Pilot maturity and scale are always relative to these factors.

The primary drawback to pilots is that they can cause an organization to lose some of its first–mover advantage where there is a large demand for an offering and competitors are also bringing to market similar offerings. Sometimes, because of these market and competitive pressures, the commercialization strategy may dictate foregoing the pilot and moving straight to full–scale production. In most situations however, this is the exception not the rule.

This Pilot Stage is referred to as the Innovation Proving Ground (or IPG). Offerings that prove their commercial viability here move on to full–scale production. Those that do not, as with any stage in the process, are rationalized or integrated into some other offering that shifts or expands its value proposition.

Throughout Stage 5, as with Stage 4, the organization is afforded many opportunities for further creative feedback loops, where they continue to learn how best to reinforce, redirect, and/or – again, where necessary – kill new ideas. With time, these loops continue to sharpen their innovation prowess.

The sixth stage of innovation management is all about scaling new offerings from either concept or pilot stage up to full–scale production in order to match the market's full potential. It completes the process of taking new business ideas from concept to reality. This is the point at which the organization will realize the full return on its innovation investment.

This stage involves making major capital investments, setting up large–scale production capability, establishing large–scale supply chains and broad–reach distribution channels, and making major marketing investments. It also involves establishing a broad–scale service infrastructure with its associated training and preparation. This is only done for those concepts that have either demonstrated their commercial viability via a pilot or that bring inherently high market confidence based on surrogate market insights.

This Scale stage is referred to as the Innovation Payback. Projects that reach full scale status here tend to pay back tens, and often hundreds, of times their investment. These are the new business ideas that make all the hard work involved – and many of the failed attempts – worthwhile. They are what ultimately accelerate the growth of a business forward.

Market Stream IM provides the basis for our consulting work in Innovation Management. To learn more, please see our Innovation Management Consulting page, or to engage us in this capacity, refer to our Management Practice Engagement page.

Market Stream IM and Responsive IE (together) provide the basis for our Corporate Innovation and Innovation Management training course. To learn more, please see our Corporate Innovation & Innovation Management Course page, or to engage us in this capacity refer to our Training Engagement page.

CEOs come and CEOs go. Some are excellent. They generally ‘get it’. Others not so much. They really ‘don't get it’. What makes the difference between these?

READ MORE

There's an insidious debate that's bounced around for probably the better part of twenty years now. It's the debate of whether or not ‘innovation is everyone's job’...

READ MORE

Innovation Spaces – which can refer to any space intentionally designed to foster and facilitate good innovation work – come in all sorts, shapes, and sizes...

READ MOREWe partner with committed business leaders to make their organizations the driving forces in their markets.

CONTACT USSign up for our newsletter.

NEWSLETTER SIGN-UP